Knowledge Centre

Browse our knowledge centre to find information on various topics, opinion pieces, advice and educational content.

News

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Articles, Blogs and Opinion pieces

Estate Planning during a divorce

Our Recommendations In an already stressful and difficult time, the last thing you want to be worrying about is estate planning. While you are still married, even if separated but not divorced, your spouse still has a claim to your estate. Ensure your Will, Life...

Capital Allowances – what can YOU claim?

Skip the details and speak directly to our Capital Allowances specialist through our Group company OCG Accountants What are Capital Allowances? Capital Allowances are a tax relief practice which allows taxpayers to deduct capital expenditure against their annual...

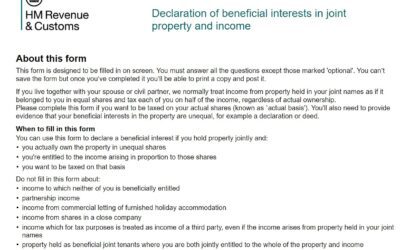

Form 17 – adjusting the split of property income between couples

The Income Tax Act 2007 (section 836) allows for income from properties that are jointly owned by married couples or civil partners that live together, to be legally split 50/50. Changes to the default 50/50 split on property income can be declared using what’s known...

Fixed vs. Variable Rate Mortgages: Which Is Right for You?

When it comes to choosing a mortgage, one of the most important decisions you’ll face is whether to opt for a fixed or variable interest rate. Whilst our mortgage brokers at OCG Mortgages can give you a more tailored comparison suited to your personal goals and needs,...

Generational Businesses – How to coach the next generation

As of 2020, it's estimated there are 4.8 million family businesses in the UK, contributing £575 billion to the UK economy. Most of these are very small, with 3 quarters being sole traders, and a further 21% having 1 - 9 employees. Speak to any family business going...

Furnished holiday lets – latest update

The time to claim capital allowances on your FHL is now As predicted, the government is still going ahead with their plans to remove the tax advantages that current furnished holiday let owners enjoy. The proposed revisions include: applying the finance cost...

Future of the Private Rental Sector

The future of the private rental sector (PRS) in the UK is a subject of considerable debate and interest, shaped by evolving economic conditions, regulatory changes, and shifting societal attitudes towards housing and landlords. As the sector faces numerous challenges...

International Pensions – A comprehensive Guide

As the world becomes increasingly interconnected, more people are working, living, and retiring in multiple countries. This global lifestyle brings unique opportunities, but it also introduces complexities, especially when it comes to planning for retirement....

How can Trusts mitigate Inheritance Tax?

Inheritance tax (IHT) is a concern for many individuals who wish to pass on their wealth to their loved ones. With the current threshold set at £325,000 per individual anything beyond this amount is taxed at a rate of 40%. However, with careful planning and the use of...

Maximise your tax efficiency when investing in property

Investing in property can be lucrative, offering both steady income and potential capital appreciation over time. However, navigating the complex world of property taxation is essential for maximising returns and minimising liabilities. There are several tax-efficient...

Webinars and Events

The future for landlords

In this webinar our Head of Property, Ben Rose, discuss the options available to landlords in the next 2 years

How to effectively structure your property portfolio

Malcolm Rose, one of our Founding Partners discusses how the structure of your property business can be streamlined

Calculators and Downloads

One Consultancy Solutions

Ask a question or enquire about a service

For specific enquiries, or to become a client please fill out the form and a member of the team will get back to you, or call us directly on 0203 988 0630